HR news 2024

We present an overview of the changes brought by the new year in the field of labour law.

Changes valid from 1st October 2023

- Home office

Labour Code has introduced rules for working from home - the employer and employee must conclude a written agreement on working from home - and in more detail has specified the reimbursement of costs arising from working from home - they can be covered by a flat rate in amount 4.60 CZK per hour, or they can be covered in amount of the costs proven by the employee, but there is also the possibility of an agreement that the costs will not be covered. Unfortunately, there is a lack of detailed regulation - recommendations - it is good to address the area of scheduling working hours and health and safety. - The request to take parental leave must be submitted in writing no later than 30 days before it starts, must indicate the duration. It can be given repeatedly up to 3 years of age of the child.

- The right of an employee caring for children under 15 or a pregnant employee to appropriate adjustment of working hours (the start and end of the shifts, reduced working hours, etc.) and the employer's obligation to comply, unless serious operating conditions prevent it - the employer must then state these in writing answer.

- Renewal of the original conditions (from above) on the basis of a request - not obligation to accept for employer but the rejection must be justified in writing

- The possibility for an employee working on the basis of an agreement outside the employment relationship, concluded for a period of at least 12 months, to request a transition to an employment relationship after 180 days of service. The employer does not have to comply, but must issue a written justification for the refusal.

- Possibility to sign working documents electronically (with the exception of wage/salary setting and documents related to termination of employment and/or resignation or removal from the leading position)

- Possibility of employment documents delivery to the employee's mailbox

- Possibility of electronic delivery of documents to an email address that is not under control of the employer and to which the employee has given consent for delivery

- Entitlement of employees working under agreements to statutory premiums (for work on weekends, at night, on bank holidays and for a difficult working environment)

- The employer's obligation to schedule working hours in writing in advance even with DPP.

- Entitlement of employees working on DPP/DPČ to obstacles at work to the same extent as employees in an employment relationship, only without wage compensation.

- Expanding the range of facts about which the employer is obliged to inform employees (including employees working on the basis of agreements outside the employment relationship), and shortening the interval by which employees must receive this information from 30 to 7 days from the beginning of the employment relationship.

Changes valid from 1st January 2024

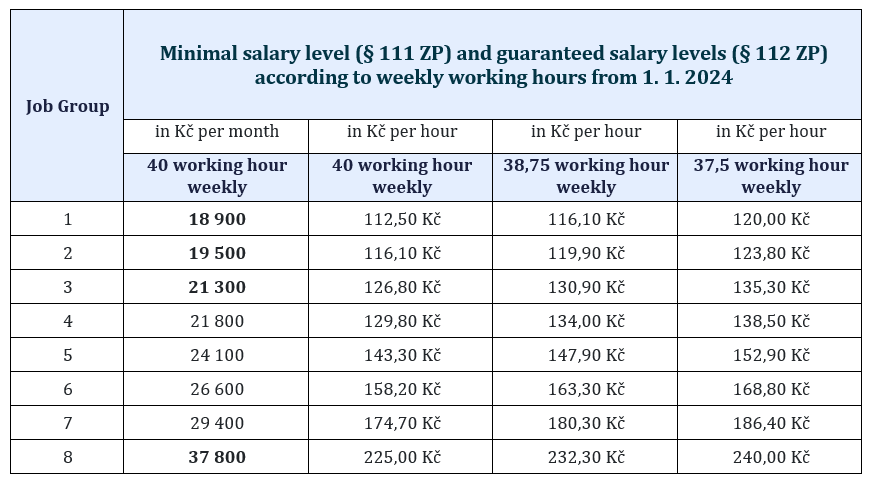

- Increase of the minimum wage from 17,300 to 18,900 CZK (from 103.80 to 112.50 CZK/hour - valid for 40 hours/week - for lower hours, the hourly rate increases)

- Increase in the guaranteed wage for job groups 1-3 and 8:

- Increase in meal allowance for business trips:

Duration of business trips

5 - 12 hours 140 CZK – 166 CZK

12 - 18 hours 212 CZK – 256 CZK

Over 18 hours 333 CZK – 398 CZK - Increase of limit for meal allowance (the amount out of taxes and levies) from 107,10 to 116,20 CZK

- Cancellation of tax exemption for over-limit meal voucher condition are lined to meal allowance

- Increase of costs reimbursement for using of private vehicle for business trips from 5,40 CZK to 5,60 CZK

- Change in fuel rates

automotive gasoline 95 octane 38,20 CZK / 1 litter

automotive gasoline 98 octane 42,60 CZK / 1 litter

diesel 38,70 CZK / 1 litter

electricity 7,70 CZK / 1 kWh

- Change in fuel rates

- Reduction of flat-rate for homeoffice costs´ reimbursement - notice 397/2023 Sb. reduces the flat-rate from 4,60 to 4,50 CZK per hour.

- Increase of average salary from 40.324 CZK to 43.967 CZK.

- Implementation of levy on sickness insurance => increase of employee levy on social insurance from 6.5 % to 7.1 %.

- Reduction of the limit for 23% tax – in 2023, the income of employees was taxed at 15% up to 4 times the average wage (i.e. up to the amount of CZK 161,296), income exceeding this limit was taxed at 23%. For 2024, the limit is reduced to 3 times the average salary (i.e. CZK 131,901).

- Cancellation of the student´s tax discount

- Cancellation of the tax discount for kindergarten fee

- Limitation of the spouse tax discount – only in case of care about children up to 3 years

- Cancelation of the possibility to deduct contributions paid to a trade union from tax base

- Cancellation of the possibility to deduct the amount paid for exams verifying the results of further education

- Change in the value of non-monetary income for company vehicles used for private purposes – introduction of a zero-emission vehicle – in that case, the non-monetary income represents 0.25% of the value of the zero-emission vehicle including VAT, 0.5% for low-emission vehicles and 1% for other motor vehicles of the value of the vehicle, including VAT, still remain in force.

- Introduction of a limit for the tax exemption of non-financial benefits (recreation, sport and culture, etc.), in the amount of ½ the average salary per year (CZK 21,983 for 2024)

- Entitlement to vacation for employees working on agreements - introduction of a fictitious working time of 20 hours per week. The condition for the creation of a claim is the duration of the agreement for at least 28 days and the completion of at least 4 times the fictitious working time - i.e. 80 hours. The entitlement is calculated in the same way as for an employment relationship. The time taken for vacation is paid and does not count towards the 300-hour limit.

Planned changes from 1st July 2024

Newly, earnings from work performance agreements will be viewed as a one amount, regardless of how many employers the income flows from. The new regulation aims to limit the so-called chaining of agreements, when workers have concluded several agreements and do not pay insurance premiums to the state and, at the same time, do not even obtain the necessary insurance period for pension entitlement.

Currently, social security and health insurance are not paid up to and including CZK 10,000 for the DPP, from 1st July 2024 the limit will be increased to 25% of the average wage, i.e. CZK 10,500 for 2024, but at the same time another limit of 40% of the average wage is being introduced , i.e. CZK 17,500 for the year 2024, for the sum of all agreements. Over these limits the levies to social and health insurance will be paid.

Author: Jana Hajdová - Payroll & HR Outsourcing Manager